Table of Content

1.Driving in NYC Isn’t Just Tough—It’s Unique

2. National Policies Can Miss the Mark in New York City

3.Why Are NYC Car Insurance Premiums So High?

4.How Local Brokers Help You Get Smarter Coverage

5.When Drivers Get Burned by the Wrong Policy

6.Why Local Claims Processing Is Faster and Friendlier

7.NYC-Specific Tips Every Car Owner Should Know

8.Need Help Understanding Your Coverage?

9. The Bottom Line

Driving in NYC Isn’t Just Tough—It’s Unique

If you’ve driven in New York City for even a week, you know it’s not like anywhere else. One wrong turn in the Bronx, and you’re stuck between a food truck and a delivery van. But what you may not realize is that the uniqueness of NYC also impacts your auto insurance—big time. Your premium could be influenced more by your ZIP code than by your actual driving history. That’s where local car insurance makes all the difference. At SecureSafer Insurance, we don’t just sell policies—we match drivers with protection that’s made for NYC’s concrete jungle.

National Policies Can Miss the Mark in New York City

Many drivers think national companies offer better deals. But when it comes to NYC-specific risks—like vandalism in a public lot or hit-and-runs on side streets—those one-size-fits-all policies often come up short. Local insurance providers understand the neighborhoods, the risks, and the real costs of repairs in New York.

Let’s say you live in Jamaica, Queens. Your neighborhood might have a higher rate of catalytic converter thefts. A local broker would know that and help you adjust your comprehensive coverage accordingly, without blowing up your premium.

ADVERTISEMENT

Why Are NYC Car Insurance Premiums So High?

According to the New York State Department of Financial Services (DFS), New York City drivers pay more for car insurance than almost any other U.S. city. That’s because the city’s high traffic volume, dense population, and constant congestion lead to more accidents, more claims, and more expensive payouts.

Local insurance brokers are familiar with how these factors play out from borough to borough. They’re able to break down what kind of coverage you actually need versus what the big-box insurers try to upsell. You can view DFS’s full auto insurance guide here.

How Local Brokers Help You Get Smarter Coverage

National companies may offer convenience, but local agents offer conversation—and in NYC, that matters. At SecureSafer, our brokers take the time to ask about your routine. Do you street-park your car overnight in the Bronx? Do you commute during peak hours in Manhattan? These small lifestyle details affect the kind of policy that’s best for you.

We work with reputable carriers approved by New York State to offer competitive options for liability, collision, and uninsured motorist protection. That includes helping you decide if your deductible makes sense for your budget, or if you qualify for parking-related or bundled discounts. We don’t cut corners—we tailor your policy for the city you live in.

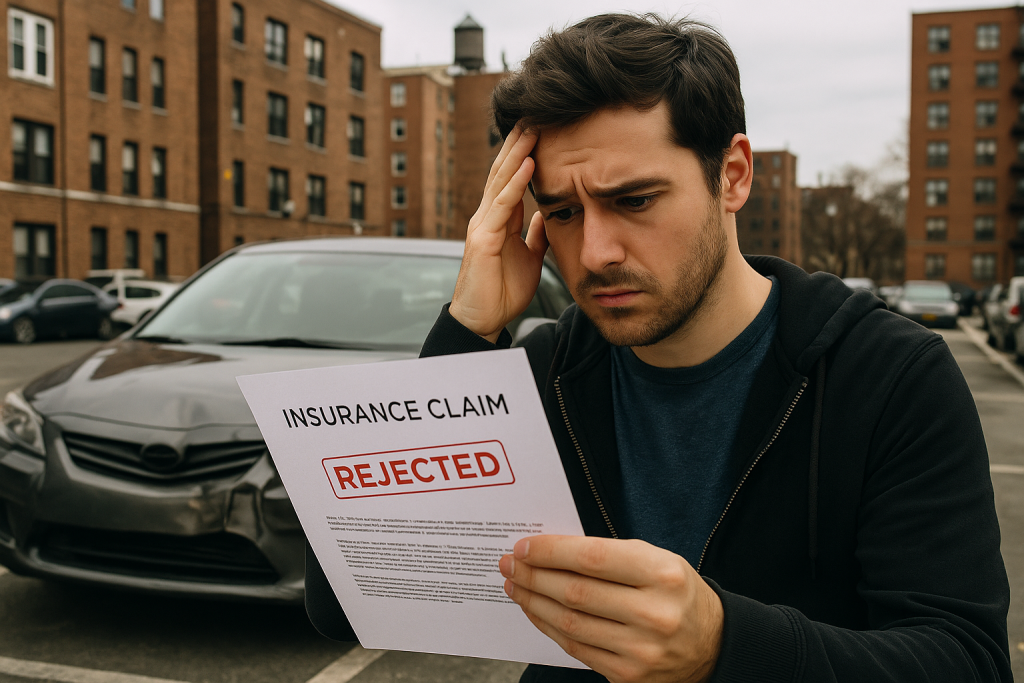

When Drivers Get Burned by the Wrong Policy

Here’s what happens when people rely on generic, national policies. Ramon, a driver in Brooklyn, was rear-ended on the BQE by someone who didn’t have any insurance. His policy lacked Uninsured Motorist Protection—something no one had ever explained to him—and he ended up paying thousands out of pocket.

Then there’s Susan from Queens, whose car was totaled during a sudden flood. Because her plan didn’t include comprehensive coverage, her insurer refused the claim. She only realized too late that flood damage wasn’t standard.

These aren’t rare cases. They’re preventable situations we see all the time—and help clients avoid every day.

ADVERTISEMENT

Why Local Claims Processing Is Faster and Friendlier

When you file a claim through a local broker, you’re not calling a call center in another state. You’re working with someone who understands that towing from Harlem to Long Island City can cost more than your deductible. We’ve built relationships with NYC-based adjusters, repair shops, and rental services. That means you get faster assessments, real-time updates, and better support throughout the claims process.

NYC-Specific Tips Every Car Owner Should Know

If you live in NYC, there are certain things your insurance must account for—whether it’s street flooding in Woodside, parking damage in Sunset Park, or snow-related incidents in Riverdale. OEM parts for repairs, higher-than-average liability limits, and clear named driver exclusions are all key features local brokers can walk you through.

And if you drive for Uber or Lyft, you’ll need special endorsements that national policies might not mention. With a local partner like SecureSafer, you don’t have to guess—we handle the paperwork and explain what matters.

SecureSafer: Insurance Made for NYC Streets

At SecureSafer Insurance, we specialize in matching NYC drivers with coverage that works, whether you’re a new driver in Queens or a multi-vehicle household in Staten Island. We also offer bundled protection if you own property, rent, or need health insurance—making your coverage smarter, not more expensive.

Our team lives here, drives here, and fights for our clients here. We’ll help you understand your options, compare policies, and make confident decisions—without the fine print confusion.

The Bottom Line

NYC isn’t like other cities. Neither should your insurance be. The potholes, parking situations, and population density demand coverage that’s locally informed and personally tailored.

Let SecureSafer help you drive smart, drive safe, and drive protected.

| Need Help Now? Don’t Wait. ✅ Call our SecureSafer team directly at SecureSafer.com or call (646) 444-2020 ✅ Request a policy review or switch evaluation today |

Compliance Note:

This article is for educational purposes only. Coverage varies by individual and policy. SecureSafer does not guarantee any savings or approvals. Visit https://dfs.ny.gov for official NY State policy guidelines and insurance regulations.

ADVERTISEMENT